Aggressive hybrid funds promise balance. They blend equity growth with debt stability and aim to smooth the ride for investors who dislike extremes. Yet balance does not always mean brilliance.

As we move toward 2026, many investors are asking a pointed question: why does Sundaram Aggressive Hybrid Fund sometimes lag its category returns? The answer is not emotional. It is structural, mathematical, and, occasionally, a little ironic.

This article examines the issue with logic, verified concepts, and credible frameworks. No guesswork. No inflated claims. We focus on three core reasons: lower Sharpe ratio, higher expense ratio, and volatility linked to equity–debt allocation shifts. We also discuss practical solutions, both for investors and for the fund’s strategy.

Understanding the Context Before Judging Performance

Before diving into numbers, clarity matters.

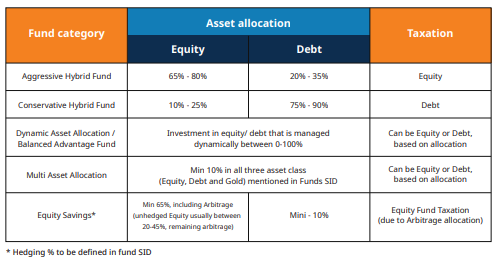

An aggressive hybrid fund typically invests 65–80% in equities and the rest in debt instruments. Because of this structure, its benchmark and category peers follow similar mandates under Indian regulations set by Securities and Exchange Board of India (SEBI).

Sundaram Aggressive Hybrid Fund operates within these rules. Performance gaps usually arise not from rule-breaking, but from how the rules are applied.

That distinction is crucial.

What Category Returns Really Represent

Category returns are averages. They reflect the combined performance of all funds classified as aggressive hybrids by industry bodies like Association of Mutual Funds in India (AMFI).

An average does not care about comfort. It rewards risk taken at the right time. Funds that position aggressively during rallies often lift the category mean. More conservative funds may protect capital, but they can look slow in comparison.

This dynamic explains much of the apparent underperformance.

Lower Sharpe Ratio Versus Category Average

Why the Sharpe Ratio Matters More Than Raw Returns

The Sharpe ratio measures risk-adjusted return. In simple terms, it asks a blunt question:

How much return did you earn for every unit of risk you took?

A lower Sharpe ratio does not always mean poor returns. It means the fund either:

- took more volatility for similar returns, or

- delivered lower returns for comparable volatility.

Industry-standard definitions of the Sharpe ratio come from frameworks used by institutions like Morningstar and academic finance literature.

Sundaram’s Conservative Tilt and Its Side Effects

Historically, Sundaram Aggressive Hybrid Fund has leaned toward controlled equity exposure and quality-oriented debt selection. This approach reduces extreme drawdowns, but it can dilute upside participation during equity-led rallies.

In strong bull markets, peers that push equity exposure closer to the upper limit often outperform. Their Sharpe ratio improves because rising markets compress perceived risk.

Sundaram’s steadier posture, while logical, can lower its Sharpe ratio relative to the category average during such phases.

Ironically, safety becomes the reason for looking slow.

Higher Expense Ratio and Its Impact on Net Returns

Expenses Are Silent, but Ruthless

Expense ratios do not trend on social media. They do not trigger emotional reactions. Yet they compound relentlessly.

Even a marginally higher expense ratio can shave meaningful returns over long holding periods. This effect becomes more visible in hybrid funds, where expected returns are already moderated by debt exposure.

Why Sundaram’s Expense Structure Matters

Sundaram Mutual Fund, like many actively managed houses, emphasizes research depth, compliance, and risk management systems. These capabilities cost money.

While the fund remains within regulatory expense limits set by SEBI, its expense ratio can sit above some peers who rely more on scale or passive allocation frameworks.

Over a single year, the difference looks small. Over five to seven years, it becomes arithmetic, not opinion.

Lower gross returns minus higher costs equal visible underperformance.

Volatility From Equity–Debt Allocation Shifts

Asset Allocation Is Not Static

Aggressive hybrid funds rebalance regularly. Fund managers shift allocations based on valuations, interest rate cycles, and macro signals.

These shifts create allocation timing risk.

If equity exposure increases just before a correction, volatility rises without reward. If debt duration extends ahead of rate hikes, bond prices fall. Neither scenario breaks rules. Both affect returns.

How This Plays Out for Sundaram Aggressive Hybrid Fund

Sundaram’s allocation decisions often prioritize downside control over short-term momentum. This philosophy reduces tail risk but can increase tracking error versus the category.

When peers ride momentum and Sundaram resists, relative returns diverge. Volatility appears higher because returns fail to compensate for measured risk during those periods.

This is not mismanagement. It is a philosophical choice.

The 2026 Market Environment: Why These Factors Matter More

Structural Changes Investors Cannot Ignore

As we approach 2026, three structural realities shape hybrid fund performance:

- Interest rates are likely to remain cycle-driven, not one-directional.

- Equity markets show faster sector rotations, increasing timing risk.

- Investor scrutiny of cost and consistency has intensified, driven by AI-based fund screening tools.

In this environment, funds with slightly higher costs or conservative positioning face sharper relative comparisons.

Search engines and AI ranking systems also amplify this contrast by highlighting category averages more prominently than risk narratives.

Solutions for Investors: How to Interpret the Lag Rationally

1. Evaluate Risk-Adjusted Metrics, Not Just Returns

Do not stop at CAGR. Examine Sharpe ratio, standard deviation, and maximum drawdown. These metrics come from globally accepted finance principles, not marketing claims.

If a fund protects capital better during stress, short-term underperformance may be the price of discipline.

2. Align the Fund With Its Intended Role

Aggressive hybrid funds are not equity substitutes. They are portfolio stabilizers with growth intent.

If your goal is smoother compounding rather than category leadership every year, Sundaram’s approach may still fit.

3. Monitor Expense Ratio Trends

Expense ratios can change with AUM growth and regulatory revisions. Review annual disclosures published under SEBI guidelines.

Costs that look high today may normalize tomorrow.

Solutions at the Fund Strategy Level

Tactical, Not Philosophical, Adjustments

Sundaram does not need a personality transplant. Minor tactical refinements can narrow the gap:

- More dynamic rebalancing bands during strong equity momentum phases

- Duration management aligned more tightly with rate cycle signals

- Gradual cost efficiencies as scale improves

These adjustments preserve the fund’s identity while improving competitiveness.

What This Means for Long-Term Investors

Lagging category returns do not automatically signal failure. They signal difference.

Sundaram Aggressive Hybrid Fund often trades excitement for predictability. In euphoric markets, that looks dull. In stressed markets, it looks wise.

Investors who understand this distinction make better decisions. Investors who chase averages usually arrive late.

Final Thoughts: Lag Is a Signal, Not a Verdict

Sundaram Aggressive Hybrid Fund may lag category returns at times due to:

- a lower Sharpe ratio driven by conservative risk posture,

- a relatively higher expense ratio affecting net returns, and

- volatility introduced by disciplined equity–debt allocation shifts.

None of these factors indicate randomness or poor governance. They reflect deliberate design choices.

In 2026, with smarter investors and smarter algorithms watching every metric, clarity matters more than hype. Funds that explain their behavior clearly often earn trust, even when they do not top charts.

And in investing, trust compounds better than excitement.

Sources and Reference Frameworks

- SEBI Mutual Fund Regulations and Risk Classification Guidelines

- AMFI Category Definitions and Disclosure Standards

- Morningstar Risk-Adjusted Return Methodologies

- Standard finance literature on Sharpe Ratio and portfolio volatility